President Donald Trump on Friday morning signed into law the Tax Cuts and Jobs Act (H.R.1), a comprehensive tax bill which will create a different tax landscape for both individuals and businesses. The key changes of the bill include, but are not limited to, the following:

Individuals

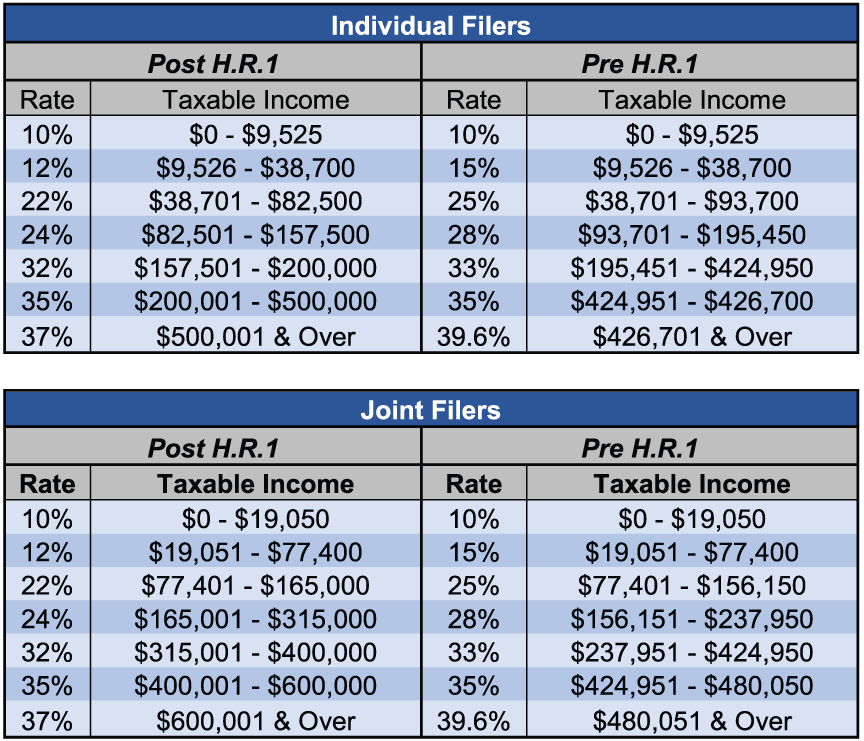

One of the largest changes in the bill is the change in the tax brackets. A comparison of both post and pre-tax bill tax brackets for individual and joint filers are depicted below:

Additional significant changes for individual taxes include, but are not limited to the following:

- AMT exemption amounts increased to $70,300 (individual) and $109,400 (joint). Related phase-out exemption begins at $500,000 (individual) and $1,000,000 (joint).

- Standard deductions increased to $12,000 (individual) and $24,000 (joint).

- Deduction for state and local taxes for income, and property and sales taxes is limited to $10,000 (married and single filers) and $5,000 (married filing separate filers).

- Expansion of tax-free Section 529 plan distributions to include those used to pay qualifying elementary and secondary school expenses, up to $10,000 per student per tax year.

- Child Tax Credit increases to $2,000 per qualified child with $1,400 being refundable. Phase out for credit increased to $200,000 (individual) and $400,000 (joint)

- 20% pass through deduction for qualified business income from S corporations, sole proprietorships, or partnerships.

- Reduces itemized deduction on principal residence and second residence mortgages up to a combined $750,000 (provisions for grandfathering in mortgages purchased before December 16, 2017 is possible depending on conditions).

- Home Equity Line of Credit deduction is removed.

- Cash gift to public charities is deductible if it doesn’t exceed 60% of AGI.

- Estate, gift and GST tax exemptions doubled to $11.2 million per US domiciliary.

- Individual mandate on health insurance has been repealed.

- Repeal of personal exemptions (was $4,050).

Businesses

The main change affecting businesses is a 21-percent corporate tax rate for 2018. The current tax schedule, pre H.R.1 has a maximum rate of 35-percent. Additional significant change includes net operating losses being generally limited to 80% of taxable income for losses starting in tax years beginning after December 31, 2017. There are also changes related to section 179 expensing, bonus depreciation, research and development credits, etc. As the tax rates for businesses vary by entity type, we recommend you speak with tax experts to gain a better understanding of how the H.R.1 will apply to your organization.

Year-End Planning Opportunities

This article has addressed some of the more significant H.R.1 changes. There are additional provisions and rules that apply, and the law includes many additional modifications.

Also, there may be some last-minute year-end 2017 tax planning opportunities; however, you will need to take action before January 1, 2018. If you have questions about what you can do before year end to maximize your savings, or if you would like additional information about how these and other tax law changes will affect you in 2018 and beyond, please contact Calibre CPA Group or your tax advisor.